It’s So Easy

As the price of Bitcoin trundles to new heights, more and more people are looking to cash in their Beenz and run like Hell before exchanges vanish or are “hacked,” and are finding it to be a rather daunting task. With the popular Magic: the Gathering Online eXchange taking almost two yearsto allow withdrawals, Bitcoiners are turning to smaller exchanges that are ill-prepared to handle the volume, small-potatoes ATMs, or shady parking lot deals made through LocalBitcoins.

We’re here today to detail the story of a man in Canada who happened to mine some Bitcoins back when CPU mining was possible, then forgot about them until the hype started to bubble the price unsustainably. This adventure is proving to be a little more difficult than expected. Here is his story so far, as outlined by SA Forums goon UberJumper:

I just learned my coworker has bitcoins from 2010. He apparently has spent most of the week trying to figure out how to convert them into USD. Mt Gox apparently wants an insane amount of personal information and even then he has to be added to a waiting list to even get any money out, and even then there is apparently some stupid low limit. But he sold some through Mt Gox, and estimates ~3 months before he can get any money out of it.

Trying to sell the coins in person, and basically saying he ether wants Cash, or a Cashiers check (since it can be handed over right then and there), has apparently been a hilarious clusterfuck.

Today he met some guy infront of his bank, and apparently as soon as he mentioned that he needs to get the cash checked to make sure it is not counterfeit, the guy freaked out and basically walked away. Stuff like this has been happening all week, and he apparently so far has only sold a single coin of several hundred.

Even more hilarious, there is apparently a place here that will buy your bitcoins from you. According to him on their site, they offer prices that are less than Mt Gox, so he tried to go in to sell them. Only to be told they will only offer 150$/coin.

Bitcoin is the currency of the future right guys?

The consensus here was “take the money and run.” Not so fast!

I would do that as well, however according to him they don’t give you the money on the spot they take the coins and then send you the funds through a wire transfer. Which means no ESCROW, given how scammy bitcoin is i think he choose the better idea.

Also apparently almost all of Gyft’s Gift Cards are not valid outside of the united states.

He’s already got funds in MTGOX, but it, of course, has problems.

Apparently he already has a 6 digit sum sitting on Mt Gox, and he is fine with giving them his personal information, which apparently can take a couple of weeks to get verified.

He is apparently scared of leaving a large amount of money on some of the other exchanges mostly because he is worried of “What if it disappears?”. He is fine with giving them his personal information, and he is willing to pay taxes/do paper work. He just wants his filthy real money.

I’ll let him know about bitstamp, he is Canadian though, the entire process so far from what i can tell has been a massive headache. I do know tonight he is apparently meeting someone who is willing to give him 500$/coin, so i have a feeling he will end up lying in a ditch somewhere.

This leads to their first experience with LocalBitcoins:

I just got back from accompanying my friend, to meet someone who wants to buy bitcoins. So we go to Starbucks, and wait for this guy who is apparently willing to pay 500$/coin, and wants 50 coins. The buyer shows up, wearing a decent suit, buys me and my friend coffee (with filthy fiat of course), and starts talking about how he buys local bitcoins and puts them on the major exchanges (I asked him if he considered himself a Captain of Industry, and got a weird look

).

Everything was going well, until the buyer tried to write my co-worker a check. Not a cashiers check, just a plain old check that will bounce if there isn’t enough money

. Which according to him is apparently as “good as a cashiers check”. He didn’t want to use an ESCROW service, and his “feedback on localbitcoins.something is all we needed to see that he is legit”. Because you know an exchange valued at 25,000$ obviously you can just trust the guys feedback. We left pretty fast.

My coworker is going to try to use bitstamp and see if he can get his money out.

*EDIT* I just realized how completely and utterly stupid this is. Who the fuck does an exchange valued at 25,000$ in a Starbucks? Shouldn’t something like this be done with Lawyers, or Accountants present? Some sort of professional service to handle exchanges like this?

Obviously this wasn’t kosher, but they were willing to give it another try.

I am supposed to go with my friend soon to meet another Captain of Industry, to try and sell 25 butts at 300$/coin. He is apparently paying cash, and has agreed to meet us at a bank, and has agreed to have the cash verified as legit.

Bitcoin is supposed to be worth 800+ according to mt gox, yet getting someone to pay even half of that value in real life is apparently too difficult.

While we waited for an update, our beleaguered heroes were informed of the ease of cashing out via Coinbase:

Guys getting money out of bitcoin is super fucking easy, according to a goon who PM’ed me said i should use coinbase, and can just drive to the US and open an account. The steps involved from what i can tell are:

1. Drive to the US

2. Open a bank account with a bank there

3. Drive home

4. Sign up for Coinbase, give them all your personal information, and wait until your verified.

5. One of the verification steps is:Complete A Purchase – Buy some bitcoin and wait at least 30 days

6. Ignore all these coinbase horror stories of that are on reddit right now.

6. Sell your coins

7. Since coinbase has no fees* they will take 1% of your money if you try to cash out.

8. Have the US Bank wire it to your other account (who knows what kind of fee it is!)CURRENCY OF THE FUTURE

Success!

My friend managed to sell 5 of his butts at 400$/butt! So he bought everyone in our group lunch

.

Also apparently when you fail coinbase’s identity verification it locks you out for 24 hours.

Someone wasn’t paying attention and suggested LocalBitcoins.

What my friend told me is that a large number of people on localbitcoins, wanted him to use something like paypal, or moneypak codes. Then kindly asking people who want to pay cash to meet at a bank, to verify the cash is not counterfeit, also apparently causes a lot of people to nope right the fuck out of there.

He can’t use gyft and cash out through giftcards because unfortunately the vast majority of the giftcards do not work in Canada.

He sold some on mt gox, and he is apparently in some cashout queue, with no real indication of how long until he can take his money out. Coinbase doesn’t let you use non american accounts to cash out. He is currently trying to get verified on VirtEx.

“Trust me.”

My friend and I went and contacted a buyer on localbitcoins, and met with him at lunch. The buyer was offering 600$/coin in cash according to the listing, and was willing to buy up to 25 coins.

My friend showed up, the buyer instead insisted on paying the entire amount in Amazon giftcards (50 bucks a card, and had a small plastic shopping bag just filled with gift cards).

I asked him how do we know the gift cards are activated? “Trust me”.

Nope.

The score so far?

He has cashed out (as in he has money in his possession and can use it) of 11 bitcoins so far i think (this is over 2 weeks). He sold 30 odd coins on Mt Gox, and is trying to cash out (he is in some sort of retarded queue and apparently there is a limit of how much money you can take out per withdrawal).

My friend is still trying to get Virtex to do anything. He filled in information and sent them all the information required, and is basically waiting for them to consider him verified. They also have a 3.0% fee on selling apparently.

Also apparently they charge you a 50$/month if you do not do anything with coins/cash on their system.

ARTICLE 13 – DORMANT ACCOUNTS

13.1 If you have not executed a trade with your VirtEx account for more than 1 year your account will be considered inactive. VirtEx will charge an inactivity fee of $50 per month up until such a time when the account balance reaches zero. BTC balances will be converted to CAD to pay for this fee, as required.

And finally:

Well this is an improvement:

Hello,

I am interested in purchasing Bitcoins and i am willing to pay $500.00 per BTC. Payment would be provided in the form of bullion gold bars of equivalent value.

Would this be a suitable exchange rate for you?

What the Christ indeed. For anyone left paying attention, cashing out in any appreciable way is a disaster, and you won’t get anything close to the “value” quoted on the various exchanges, which isn’t terribly surprising given that they seem to be subject to manipulation and in no way represent what people are actually receiving for their pogs. If UberJumper and his Bitcoin millionaire pal manage to get anything more out of the system, we’ll let you know.

November 27, 2013 @ 11:15 am

Totally a real currency with actual worth. You can tell by the way people have no issue exchanging it for their dollars. Totally a real currency. Totally a real currency. Totally a real currency.

January 4, 2014 @ 4:54 pm

Do you trade USD for other currencies regularly?

I don’t trade my bitcoins for USD regularly, I buy things with them. Just like I buy things with dollars. If you look at any exchange’s volume, clearly most people are not trading their BTC for dollars. And yet so many bitcoins are exchanged per day within the network? What do you call that? Not commerce?

January 8, 2014 @ 2:18 am

“If you look at any exchange’s volume, clearly most people are not trading their BTC for dollars”

No.. If you look at the numbers of the 150k top bitcoin wallets online: http://codesuppository.blogspot.com/2014/01/show-me-money-scatter-graph-of-all.html

“Number with 0 spent: 130,769

Median number of transactions: 1

Mean number

of transactions: 8.828

Median days since last transaction: 501

Mean days

since last transaction: 694.383”

, you will see that most bitcoiners don’t spend coins, they sit on them, hoping to cash out big in the future.

November 27, 2013 @ 12:48 pm

So you can’t withdraw USD from Gox but can you send the coins that are there to another wallet/exchange?

November 27, 2013 @ 12:55 pm

Maybe. I keep hearing that you have to go through some ridiculous verification process before they’ll allow you to transfer out.

November 28, 2013 @ 9:03 am

Yes. But without verification and “know your customer” policy (obligatory for every other bank and exchange), there is a real risk of exchange being shut by regulator. If you want to run any exchange or any other financial service, you must do that.

November 28, 2013 @ 9:41 am

Real currencies don’t have these weird limitations, at least for the amounts of currency a “regular” person would be exchanging. I can walk into my neighborhood bank, hand them CAD$30 my friend from Canada gave me, and without any more fuss get US$25. Or even Euros, pounds, or pesos.

That’s the very point of this article. It’s extremely difficult, nigh-on impossible, for a small guy to get their BTC into their local currency without Herculean effort. It’s not a regulatory problem: it’s an almost designed-in feature of BTC.

November 28, 2013 @ 9:59 am

BTC is not a real currency…yet (by currency I mean universaly accepted medium of exchange). Will it ever be? I don’t know. It’s intriguing experiment. That’s for sure. But critisizing BTC because of this issues now, when is still in it’s infancy and completely without infrastructure is really nothing more than economic ignorance. It’s like laughing at first automobile, because is too slow and shaky.

November 28, 2013 @ 10:08 am

No, it’s like laughing at steam automobiles when everybody else is building internal combustion engined ones. We have a system that works presently for most people (the “connected” ACH and credit exchanges), has reasonable protections built into the system so that it “just works” for the vast majority of consumers, and works on a commodity everybody understands.

Bitcoin solves a problem most people don’t have. Cart is before the horse here. Little guys need to be able to get their value out of BTC, otherwise get ready for another nasty crash very soon.

November 28, 2013 @ 10:20 am

It’s all about transaction cost. We have money, because we don’t like barter exchange which has huge transaction cost. Paper money have lower transaction cost than gold. That’s why we started to use paper. First backed by gold, then goverment intervened and screwed things up. And BTC has much lower transaction cost than current money. That’s real adventage. Think of how much may people save when using BTC. Don’t you thing they will rather use system with no or very low fees than Western Union with it’s ridiculous 8 %plus fee?

November 29, 2013 @ 8:06 pm

They have a better choice than Bitcoin. Works with their existing bank accounts, doesn’t require any “exchange rate” funny-business, and is in fact guaranteed.against fraud. It’s called the existing ACH/Credit exchanges, and all the systems that work with it, including Western Union (although Western Union serves a very specific market segment).

Do you know the history of PayPal? Clue: Bitcoin isn’t the first attempt to create a cryptocurrency, there was a system that everybody has long forgotten about.. that indirectly became the company PayPal is today.

December 2, 2013 @ 8:24 pm

PayPal will let you send donations to the KKK but not to WikiLeaks? That’s sad, but it’s not even the biggest problem; try using PayPal to pay somebody in China:

* website, invoice and e-mail payments are 4.4% + $0.30 USD

* eBay payments are 3.9% + $0.30 USD

* micro-payments are 6.0% + $0.50 USD

* withdrawals are $150 or more and a $35 USD fee.

All of this gets paid by the merchant, so sure: Average Joe thinks PayPal is free to use, but the cost gets included in the price of what he’s buying without him actually knowing. With Bitcoin these payments can be achieved with as low as 0% transaction cost. That’s simply impossible with PayPal, regardless of how you skin it!

January 1, 2014 @ 9:58 pm

So, genius, how does one get Bitcoin? Or, how does one get money out of Bitcoin?

Hint: I think this article is explaining the problem. It’s not that easy.

Meanwhile, Square, PayPal, Popmoney, and a whole host of other services (that are tied to conventional credit cards and ACH transactions) are comparatively easy to deal with, have some protections against fraud, and don’t require any shady parking-lot deals with the unsavory and the unshowered.

January 4, 2014 @ 4:52 pm

Sounds like you’re a genuine retard. I sure hope you were shitting on dial-up back in the day. Bitcoin as everyday currency? Fuck that noise, but I’ve used it so many times to coordinate my business projects with international actors on a global stage. I’m sorry that you don’t see the tremendous value afforded to me being able to instantly send someone BTC worth 10,000 US which they then used to purchase hardware directly in BTC to their local address.

June 10, 2014 @ 10:28 pm

I’m retarded so I definitely find your story about your “business” credible.

June 10, 2014 @ 11:55 pm

I don’t give a single fuck what you think. I may spend 10,000 US on drugs, guns, oil, gold, or anything I can find for sale on Bitpremier, or I might use it to make sure a developer in a country which has tough money wiring policies can get the equipment they need. A major difference between you and I is that only one of us made 15.000.000 NOK in the expansion of cryptocurrency. This experience, or lack of on your part, has permanently colored how each of us will view digital money. You missed out, big, while others profited and will continue to profit as they reinvest their earnings into blockchain related ventures or technology companies in general.

Don’t be mad, digital cash is a vehicle. It’s about how you use it.

June 11, 2014 @ 11:13 am

Like I said, I’m a drooling retard so I find your story incredibly plausible.

December 21, 2013 @ 5:31 pm

ACH and Western Union work well.

Says someone who has clearly never ever, ever, ever used them.

Seriously, how do you not realize how fucking retarded and disingenuous you are being.

Bitcoins can be traded just like cash. And they can be exchanged for other commodities on an exchange. JUST LIKE FUCKING CASH

You’re so stupid.

January 1, 2014 @ 9:53 pm

You know what else works just like fucking cash?

Cash.

Who’s the “retard”?

December 11, 2013 @ 9:25 am

The fact that bit coin can’t be used for 99% of the things I need to buy in life is a pretty good indication that people aren’t that eager to replace their dollars with libertarian funbux

June 10, 2014 @ 10:26 pm

Your understanding of history is woefully inaccurate.

November 28, 2013 @ 10:00 pm

The biggest problem is that the most ardent buttcoiners are too incompetent to recognise that there are problems with buttcoins. It’s a classic example of the Dunning-Kruger Effect.

November 29, 2013 @ 12:03 am

No, that’s not problem at all. Quality of any currency depend on some key (user independent) factors like portability, divisibility, homogenity, transaction cost, indestructibility and stability of value. It has nothing to do with some naive redditors hoping to make quick buck.

November 30, 2013 @ 3:35 am

Right, because being able to make quick, easy transactions in a fast-moving market is of no importance whatsoever. Many of the problems plaguing buttcoins CAN be fixed and fixed easily, there is simply no desire to make these fixes.

December 9, 2013 @ 11:18 pm

That’s why we call them Dunning-Krugerrands.

January 4, 2014 @ 4:48 pm

Sounds like you’re too busy building strawmen to acknowledge all the work ‘buttcoiners’ are doing to get acceptance. For a project that’s 5 years old? Holy shit, it’s some amazing ignorance on this site for sure. Imagine people shitting on the Web back in the dial-up days. I mean people did, but holy fuck were they stupid and we all see it now!

January 25, 2014 @ 7:41 am

But the first automobile could still carry you and that 50-pound suitcase across town more easily than if you were walking. Cars had INSTANT utility, which is why they caught on. This is not the case with Bitcoin.

November 29, 2013 @ 6:49 pm

Actually real currencies do have these limitations too, who do you think the KYC/AML laws were created for? Furthermore, most banks won’t let you exchange currency unless you already have an account with them. If you have an account with the bank, then you’ve already submitted the same documents that these exchanges are requiring. BitStamp takes about 1 business day to get verified: i.e. submit all the documents (ID + proof of address) and allow you to withdraw money.

I sell about $20K worth of BTC every month and it takes about 3 days to get the money transferred to my bank account from BitStamp. I have never had any problems with BitStamp and it costs me only 0.9 EUR to get it transferred to my account in Europe.

November 29, 2013 @ 8:00 pm

No, they don’t.

Did you even read my example? I WALKED INTO A BRANCH OF USBANK IN DOWNTOWN PORTLAND, HANDED THE GUY AT THE CURRENCY EXCHANGE COUNTER CAD$30, AND HE HANDED ME US CURRENCY. I DID NOT HAVE AN ACCOUNT AT THAT BANK. I DO NOT RECALL HIM REQUESTING, OR ME HANDING HIM ID.

That’s the point. For the little guy, exchanging BTC is a royal pain in the ass. Until it’s that easy, you have a problem.

December 2, 2013 @ 8:04 pm

Which is why I said “MOST” banks, not “ALL” banks. I have had to exchange EUR and CAD for USD at Citibank in Chicago and they will only do the exchange if I have an account, so I had to swipe my card and enter my pin code just to exchange 40 EUR and 100 CAD. I’ve walked into several other banks and they too have requested that I have an account. Furthermore, the Bitcoin exchange services only require you to show ID only once and that’s upon registration. The verification process at BitStamp is about a day (or two at worst). It’s hardly a problem for anybody that uses BTC.

But you totally missed my point: the “weird limitations” do exist for all other currencies, especially when you start exchanging larger amounts (i.e. $10K or more). Again, KYC/AML laws are nothing new, they’ve been around LOOOONG before Bitcoin came into existence.

December 21, 2013 @ 5:30 pm

Hand me $800 and I will wire you a bitcoin immediately

If you were being genuine at all, you would compare it to making trades on TD Ameritrade, and if you knew anything, you’d know that it’s about 10x harder to get confirmed on TD Ameritrade and make trades than it is on any Bitcoin exchange.

December 21, 2013 @ 5:45 pm

http://youtu.be/_JgHHigAAyg?t=35s

The watch is my money and pointy beard is buttcoins.

January 25, 2014 @ 7:40 am

I wouldn’t hand you $800 for BTC: no way to stop you from running off with my money. At TD Ameritrade, if they walk off with my money, the law will kick their asses for me.

January 5, 2014 @ 8:18 pm

I could go to any Travelex office in the world and do the same, without jumping through any of the ridiculous hoops I’d have to go through to do the same with bitcoin.

December 21, 2013 @ 5:29 pm

“really currencies don’t have these weird limitations”?

You’re insane idiotic. Are you kidding me? You realize these limitations are ACH REQUIREMENTS. As in, THEYRE ONLY NECESSARY BECAUSE OF USD REGULATIONS.

Holy shit, you’re either the dumbest person I’ve ever met talking about Bitcoin, or you’re intentionally lying and manipulating an obvious reality to fit your agenda.

December 21, 2013 @ 5:27 pm

Yeah, god forbid they try to verify your identity before allowing you to perform arbitrary ACH transfers. I get that this blog is biased and misinformed and exaggerates and lies in order to make a point, but this is even more sad that usual.

November 27, 2013 @ 4:03 pm

S. C. Johnson & Son should sue MtGox for infringement on its Roach Motel patent.

November 27, 2013 @ 4:04 pm

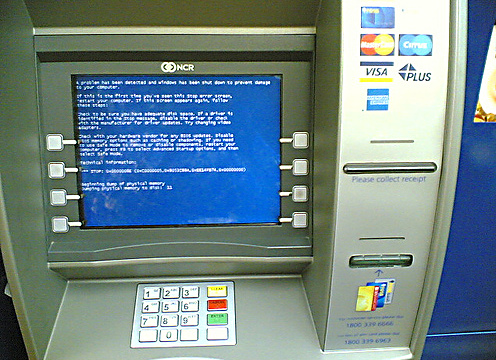

There’s a Bitcoin ATM somewhere in Canada. Go there, or have a relative/friend go there.

November 28, 2013 @ 9:36 am

How convenient. Funny, I don’t have to go to Canada to exchange .. CAD$. I can just go to my bank.

December 4, 2013 @ 7:13 pm

The guy is already in Canada.

December 24, 2013 @ 12:52 pm

Yeah, it’s not like Canada’s a big country or anything. It’s probably within walking distance!

November 27, 2013 @ 4:22 pm

Bitcoin is decentralized. No one is in charge, why do you think it’s a scam if you have to pay a private company a fee to exchange your money?

November 27, 2013 @ 4:30 pm

lol if you can’t figure it out

November 30, 2013 @ 9:04 pm

It’s so decentralized that there are *gasp* exchanges set up!

DECENTRALIZATION DA FUTURE!

February 14, 2014 @ 1:10 am

your baby is ugly and stupid just like you

February 14, 2014 @ 7:33 am

How brave of you.

November 27, 2013 @ 8:02 pm

Gonna guess that the exchanges put selling customers in a queue so they (the exchange) can sell their own butts at a healthier profit.

November 28, 2013 @ 11:25 am

Well, maybe it’s not a real currency yet in Canada. As far as I know Japanese guys can get yens from Mt.Gox, Americans can use Coinbase and we in Europe have Bitstamp to cash out. And Chinese have their own exchange in China. So that’s perhaps a problem that only really exists in Canada and other smaller players on the world scale. But that’s the problem with businesses in Canada/the fact that Bitcoin is not as widespread in Canada to have a good exchange…. Not a problem with Bitcoin itself.

January 7, 2014 @ 5:25 pm

Blame Canada..?

December 3, 2013 @ 12:23 am

so you guys heard about this (http://byznys.lidovky.cz/velka-internetova-loupez-za-800-milionu-stopa-vede-k-ceskemu-programatorovi-16e-/firmy-trhy.aspx?c=A131202_110252_firmy-trhy_mev), right?

Not a real currency until someone steals $100M USD worth of it, amirite?

December 4, 2013 @ 2:22 pm

So basically they guy went to all this trouble because he was too impatient to get registered on CaVirtex? It’s a good exchange with legit withdraws. They just have a backlog of verification applications right now.

December 6, 2013 @ 1:53 pm

“Just”

Saying “this thing works except it doesn’t” means it doesn’t work.

December 6, 2013 @ 3:13 pm

This situation is more like: “Damn, it takes a whole week to open an account and cash all these penny stocks I inherited? I can’t wait that long! Better just go meet the Mafia in a back alley instead.”

December 6, 2013 @ 3:16 pm

Wait, which one is it? A currency or an investment? Because if bitcoin is just an investment I can see your point but if you think regular people will treat it as a currency with these kind of problems you’re out of your fucking mind.

December 6, 2013 @ 6:34 pm

It has the potential to be a currency some day. But right now I think of it more as an excellent payment network, and a speculative vehicle. As far as spending it, it’s a token that’s accepted by a few thousand vendors worldwide. But just because it hasn’t reached critical acceptance doesn’t mean the technology isn’t amazing.

Think of the first few thousand people with email addresses. They had to pay for those and there was hardly anyone else to correspond with. It wasn’t user friendly, or easy to set up, but the idea of an unlimited, nearly instant, global messaging protocol was fresh and exciting. That’s exactly how it feels to send and receive bitcoins, it’s like emailing money.

Back when there was only command-line interface email people would have said the same thing you just said about bitcoin, and they’d be right. Regular people would not have treated it as a form of communication on par with faxes, telephones, and letters. Why pay for and set up an email sever that you have to connect to with dial-up when you can just press a button on a plug-and-play fax machine?

Also, for the sake of argument, how hard would it be to trade a large amount of a rare currency that was only 4 years old? The guy in the story would have just as much trouble trying to cash out a giant sack full of Latvian Lats.

December 24, 2013 @ 12:51 pm

I would totally buy a giant pile of lats, though. They’re pretty nice and the looming conversion to the Euro is driving up the collector value right now. advantage: Latvia

December 18, 2013 @ 2:01 pm

I knew Bitcoin was a SCAM when I started to hear that cornball PAY-triot right wing kook Alex Jones promoting them as an “investment” on his radio show on Infowars dot com. Anything that Alex Jones shills for or sponsors on his radio circus is GUARANTEED to be a SCAM and Snake-Oil. Like they say, there’s one born every minute!

January 26, 2014 @ 11:23 pm

I find it funny that people are complaining about companies charging a fee to render a service for them… I mean the effin nerve of someone to try to make money in a business

January 28, 2014 @ 5:11 pm

I’m always amazed at the stories about how hard it is to get an account on an exchange. I have set up accounts on three exchanges with few issues and been able to move cash and Bitcoin in and out. It’s no more difficult than setting up a brokerage account. You can set up an account on U.S. based Coinbase in a few minutes and transfer Bitcoin into it, sell them, and have the dollars transferred into your bank account – basically the same concept as buying and selling stocks. Not sure what the major malfunction is and all of the horror stories about people getting in and out of Bitcoin. It may not be so simple a caveman can do it, but you don’t have to be Albert Einstein either.

July 3, 2014 @ 5:04 pm

Fuck this site. Bitcoin just did the authors Momma. And Ddogecoin just raped the cat.

July 3, 2014 @ 9:52 pm

Are you having a stroke?

December 26, 2014 @ 7:38 am

The people who run this site helped invent Dogecoin as a joke, which backfired horribly when the same idiots who can’t tell Bitcoin is a scam proved (shockingly) unable to recognize another even more transparent scam.