How a central authority attempted (and failed) to regulate Bitcoin

Back during the largest of the Bitcoin bubbles, and even to this day, the largest Bitcoin “exchange” is the Magic the Gathering Online Exchange (MtGOX,) a website where the vast majority of USD to Bitcoin transfers takes place and the largest Bitcoin “authority,” so to speak. To many, MtGOX was the hub for Bitcoin activity. It may still be. I’m not going to visit a website called the Magic the Gathering Online Exchange to find out.

As the price of Bitcoins was falling like a rock dropped from a burning zeppelin, MtGOX enacted various “walls” in an attempt to halt the precipitous fall in the “value” of Bitcions. These, of course, did not work, but it’s hilarious how those who screech to the heavens and back about removing central authorities from currency and babble on about fiat this and fiat that allowed and probably encouraged this occurrence. Let’s take a closer look at how the Magic the Gathering Online Exchange admins attempted to rig Bitcoin prices to save their investment:

Imagine, for a moment, that you’re terribly foolhardy and have spent real money on ten thousand Bitcoins. You take a moment to meander over to MtGOX to play Internet Day Trader with your fake money and find the following outstanding buy orders:

- 100btc @ $15.50

- 50btc @ $15.65

- 30btc @ $15.52

- 30000btc @ $14.95

What this means is that you could sell your play money to other suckers for around $14.95. The first 180 Bitcoins would, of course, sell at the higher prices, but the vast majority will go for the lowest listed price. Someone out there believes for some misguided reason that Bitcoins are worth $14.95 and is willing to pay that for a lot of them.

Now let’s imagine that 30000 Bitcoin wall is no longer there:

- 100btc @ $15.50

- 50btc @ $15.65

- 30btc @ $15.52

You can sell your first 180 Bitcoins immediately for the prices above, but then you’re still stuck with 9,820 of the damned things that you no longer want because you’ve come to your senses and realized this was all a terrible idea and you want out. You’re stuck with them until someone else comes along and places an order to buy some, and if they’re smart (and some of them actually are, they’re busy scamming the rest of the Bitcoiners,) they will split their buy order into small batches, each with an increasingly lower price, screwing you out of whatever value everyone agrees your hashes and bits and whatnot have.

This happens in the real stock markets too, but the amount of large companies involved ensures that only the little day trading guy gets screwed while the market itself doesn’t melt down. Large standing buy orders help to stabilize prices and without them one would see the hilarious roller coaster prices that Bitcoin is prone to having.

Now that we know all this, we can look at MtGOX when Bitcoin prices were tanking and see that in our above example, you wouldn’t have actually been able to sell at $14.95, because the 30,000 Bitcoin order was a fake wall and the moment the orders at $15.52 were fulfilled, the orders at $14.95 would disappear and quickly be replaced by another at a lower price. This happened numerous times and at any given time MtGOX’s market depth would show ten to fifty thousand Bitcoins’ worth of orders within one dollar of the current price. As the price plummeted, say by $3 within an hour, we would see that only Bitcoins in the volume of one to five thousand had been traded during that period of time, which would indicate that the large order had been pulled and replaced with another order for tens of thousands of Bitcoins just below the current price.

This happened over forty times during Bitcoin’s freefall from $20 to $5. The invisible hand of the free market at work!

Special thanks to SA forum goons Shifty Pony and I Greyhound for explaining all this garbage so I could paraphrase it here.

January 21, 2013 @ 11:38 am

Regarding Bitcoins and gold, it’s important to keep in mind that neither has “intrinsic” value.

Rather, both are valued by men for their unique properties.

Gold is:

* Divisible.

* Fungible.

* Value dense.

* Recognizable.

* Durable.

* Zero counter-party risk.

* Stable in supply, yet minable.

* Liquid.

* International.

* Non-manipulatable. (Non-centralized.)

By comparison:

* Diamonds, while valuable, are NOT divisible, nor are they fungible.

* Water, while valuable and divisible, is not value-dense enough to compete with gold as a form of money, on the free market.

* Food, while valuable, is not durable.

* Dollars, while liquid, do not represent zero-counter-party-risk (rather, they are debt-based.)

* Dollars, while recognizable, are not stable in supply (inflation is a worry).

* Dollars are also not minable. (Production is available only to a monopoly cartel, versus gold, which anyone can produce.)

* Food, which anyone can produce, is not liquid, especially in comparison to dollars or gold.

* Dollars, while you can hold them in your pocket, a board of bankers still has the power to reach into your pocket and manipulate its value. (This is not the case with gold.)

Soon it becomes very clear that gold was never “declared” to be a form of money by any “authorities” but rather, became money due to natural market forces.

If gold became money strictly due to natural market forces (as a result of its unique properties) then clearly the only reason it has been supplanted by dollars is due to artificial restraints imposed on the market by government force. (Such as legal tender “laws”, tax “laws”, money laundering “laws”, etc.)

Such forces must be constantly active, otherwise, natural market forces would immediately resolve back to gold again as they have for thousands of years.

Now let’s consider Bitcoin’s unique properties:

* Divisible.

* Fungible.

* Value dense.

* Recognizable.

* Durable.

* Zero counter-party risk.

* Stable in supply, yet minable.

* Liquid.

* International.

* Non-manipulatable. (Non-centralized.)

AS WELL AS:

* Non-confiscatable.

* Accounts cannot be frozen.

* Anonymity is possible.

* Electronically transferrable.

As you can see, Bitcoin’s unique properties are similar to those of gold, although it adds new properties due to its ethereal nature.

Those new properties (non-confiscatable, non-freezable, pseudonymous, transferrable electronically) all serve to route-around the artificial forces that are currently being used to supplant gold with the dollar. After all, the various immoral, legal-tender legislation in place today uses the force of a gun to impose fiat money onto an economy that would otherwise resolve to gold by natural forces. That artificial force depends on the government’s collusion with banks and their collective monopoly on the ability to issue, store, freeze, confiscate, track, and transfer dollars.

January 21, 2013 @ 11:43 am

Oh my god look at this fuckin carepost right here. Dude, you are in the wrong place to be preaching about buttcoins.

January 21, 2013 @ 11:51 am

AHAHAHA dem words what a bafoon

June 2, 2013 @ 7:47 pm

Gold has intrinsic value in manufacturing electronics… It also has intrinsic value in its beauty… I’m not sure how you got that gold has no intrinsic value.

January 21, 2013 @ 11:52 am

Maybe you should spend some time trading any or all of the world’s capital markets and then what seems so shocking to you suddenly won’t.

I do love your booing though. Does make me laugh.

January 21, 2013 @ 12:01 pm

you here to crow about play money and Ron Paul too?

January 21, 2013 @ 12:42 pm

Nah. Just here to crow about how my Buttcoin investment has seen a 300% return in the last 9 months. I’ll throw you some scraps if you ask nicely. x

January 21, 2013 @ 12:43 pm

“bitcoin investment” nice one

January 31, 2013 @ 3:42 pm

“Maybe you should spend some time trading any or all of the world’s capital markets”

If you actually did this you would certainly be posting about it in buttcoin.org, the host for all Masters of Capital.

January 21, 2013 @ 12:35 pm

How can people be so stupid?

January 21, 2013 @ 12:43 pm

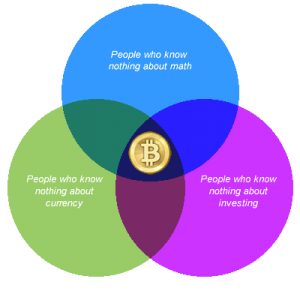

It gets said a lot on the internet and a lot of the time it probably doesn’t apply, but Bitcioners really are a special case of the Dunning-Kruger effect. Combine that with the typical libertarian “fuck you, got mine” mentality and various other seedy, scammy bottom-feeders and you have Bitcoin!

January 23, 2013 @ 10:07 am

So the above article actually makes sense to you?

January 21, 2013 @ 2:32 pm

This is misguided on so many levels that I find it hard to figure out where to start. I guess I’ll start with your idea that “if the 3000 wall was not there” which already speaks a lot for itself:

1. I suspect you mean the 30k wall @14.95, not the 3k wall, since you show 30k at the 14.95 market depth.

2. You propose an unrealistic hypothetical situation and then you proceed to tear down a straw-man which has nothing to do with reality. Exactly why wouldn’t there be any market depth support beyond 14.95? What does the market depth look like at 14.94, how about 14.93? Do the orders at greater market depths magically disappear too?

3. You suggest that making iceberg orders will somehow give the buyer an advantage and if that was the case, then you should be able to make a good bank taking advantage of all of those “suckers” trying to sell. Why aren’t you doing it? Oh, let me guess: you don’t like “buttcoins,” well no worries… just make your bank and exit when you’re holding fiat. I would love to have a schmuck like you keep making iceberg buys while I make iceberg sells!

4. Finally, you say that the same thing could happen in the stock markets, but it just doesn’t happen because the large companies involved “keep the market from melting.” Or perhaps it’s just that people understand efficient markets and spend a lot of money trying to evaluate the true market value of the equity they’re holding. I guess we’ll never really know why!

5. Finally, what about the hundreds of small FX and Futures markets? If your hypothetical had any connection with reality, then you would see hundreds of smaller FX and Futures markets melting every day because of people who have heard about iceberg orders. Ever wonder why that’s not happening?

Unfortunately, your understanding of how efficient markets work is about as high as the average rock out there!

January 21, 2013 @ 2:33 pm

Would you say it’s …. “VERY MISLEADING”??

January 21, 2013 @ 2:34 pm

That would be a VERY NICE WAY TO PUT IT! 🙂

January 21, 2013 @ 3:14 pm

:ironicat:

January 21, 2013 @ 3:18 pm

You highly informed response is greatly appreciated! 🙂

January 21, 2013 @ 8:45 pm

this was written without looking at the months long increase in price, correct? the author should do his homework before spouting off such ignorance.

February 28, 2013 @ 2:37 pm

What does an increase in price at a different time have to do with the actions taken by MtGOX during the freefall?