Whoa, what just happened here?

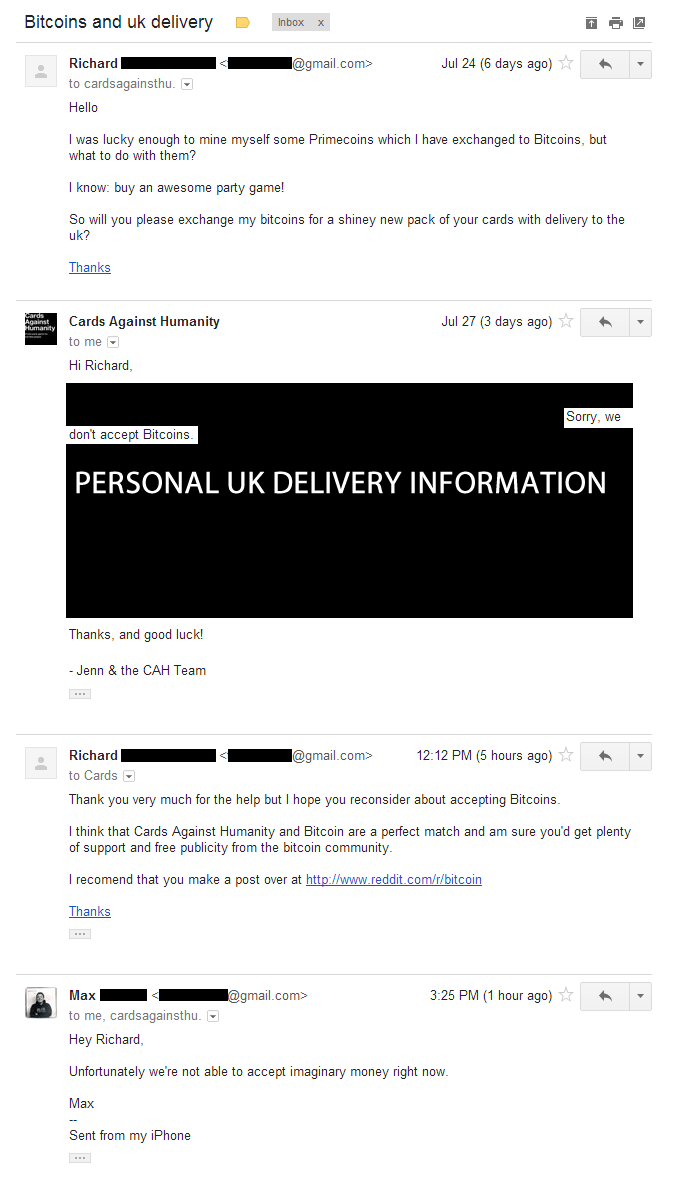

The reddit Buttcoin tip bot is considered by bitcoiners to be a fantastic way to “spread awareness” and attempt to indoctrinate others, bringing them into the cult of Buttcoin. We’ll delve deeper into the workings of this bot (it’s how I got my .05 Bitcoins,) but for now, we’d like to take a look at the following exchange, as outlined by the SA Forums’ Buttcoin poop-scooper, …!

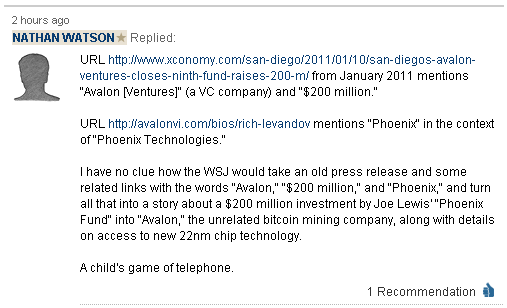

[Bitcoiners] genuinely believe that if everyone found out about Buttcoin tipping then they would see that Bitcoins are awesome. They really believe that throwing a nickel at someone will make them a bitcoiner for life. Its so bizarre.

Its also funny watching Reddit bitcoiners start posting in random subreddits to do blatantly obvious buttcoin shilling. This is how it ALWAYS goes:

bitcoiner 1 writes some post tangentially related to whatever subreddit they’re infiltrating that day

bitcoiner 2: good point! bitcointip 0.02 USD

bitcoiner 1: this is amazing! thank you so much! this buttcoin thing sure sounds cool! im gonna go create a buttcoin wallet right now!

bitcoiner 3: whoa, what just happened here? <— that line is nearly always worded identically to that

bitcoiner 2: allow me to explain this awesome new thing called bitcoins

bitcoiner 2 spews five paragraphs of libertarian jargon and other nonsense

bitcoiners 4 – 7 post about how this is obviously the future and how they’re going to go right fucking now and get them some bitcoins, dammitThat is the exact thing that they do every. single. time. It’s like they dont realize how transparent they are.

It really is this obvious, and they get fantastically upset when you call them out.