Grab your popcorn, bitcoin approaches $50 in the middle of a runaway expanding bubble and when it pops it’s going to get ugly.

EDIT: It’s crashing now, watch it live here.

If you haven’t heard, bitcoin surpassed it’s previous high of $32 and is very rapidly approaching $50. There really isn’t any reason for the rally over the past week or so besides Kim Dotcom saying he wants a bitcoin credit card for his illegal file sharing service and some dude from the Pirate Bay saying he expects Bitcoins to reach $100,000.

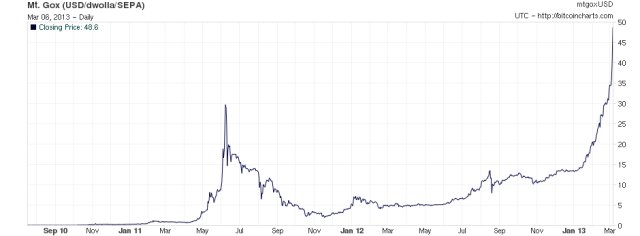

Look at this crazy graph that’s totally normal and sane for a stable currency.

This is not normal. THIS IS NOT NORMAL YOU IDIOTS.

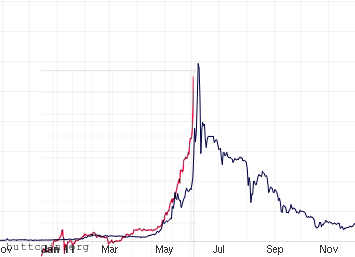

Here’s the recent bubble overlaid over the last bubble.

We’re a few days away from a repeat of the last crash, and it’s gonna be just as bad this time.

Remember when you were a kid, playing with Lego? And you tried to build a giant Lego tower, but you didn’t build a base for it, just stacked Lego on top of Lego until it was all wobbly and fell over.

Let’s look at the volatility over the past hour as bitcoin reaches it’s unsustainable peak and tumbles down.

Wild spikes of a dollar or more, this is the currency of the future folks.

So grab your popcorn folks, it’s about to get REAL good!

March 6, 2013 @ 2:02 pm

It’s not “crashing now” you fucking idiot.

March 6, 2013 @ 2:37 pm

I’m having a hearty laugh watching buttcoiners try to prop up the price as it crashes.

March 6, 2013 @ 3:06 pm

Or maybe *gasp*, they are legitimate buyers. The article says that Bitcoin is finally crashing, I’ll bet you that it wont go down more than ten within the next 24 hours.

March 6, 2013 @ 3:08 pm

Crash doesn’t have to mean 0. Losing 20% of value in a single day like you said seems like a big deal to me.

March 7, 2013 @ 6:09 pm

lol @ the author of this post. He must be one of the 1%… that lost money on bitcoin.

March 7, 2013 @ 6:12 pm

The only way to win with Bitcoins is to never play the game.

March 11, 2013 @ 1:27 pm

Looks like you’re going to have to try harder, it’s still not crashing…

Yeah wohooo crashed 10$, back up 10$, whocares, did you watch facebook’s IPO?

Anyway nevermind, you talking for it or against it doesn’t really make a difference, so go ahead. By all means have fun 🙂

March 20, 2013 @ 9:45 am

This is not normal YOU IDIOTS:

http://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1363809600000&chddm=3250774&chls=IntervalBasedLine&q=NASDAQ:AAPL&ntsp=0&ei=9-ZJUaCYLI3CwAOJCQ

March 20, 2013 @ 9:49 am

I don’t even know what you’re trying to point out here.

March 20, 2013 @ 8:02 pm

If you drag the date range a little bit back and forth you will find several places where Apple experienced just as strong growth as bitcoin does now, it doesn’t collapse, just keeps on going after corrections. Thing with financial markets are that they are fractal in nature and they don’t care about scales. In your example above where you superimposed the last “bubble” and this “bubble”: Have you ever considered that this new “bubble” can have the same shape as the last one, just not the same scale and that the recent buildup to 50 is the buildup where the last one went from 0.1 to 5? That first little blip. That would mean the target price is 320 this time. Its not difficult at all to believe that there are 100, 1000 even 10.000 times more people involved in the bidding now compared to last time making this happen. In 2011 im certain the amount of people even aware of bitcoin and being involved where in the hundreds / few thousands. We are talking millions now.

March 20, 2013 @ 9:14 pm

Are you seriously comparing bitcoins to the most successful and profitable business in the last 50 years? A company that last quarter scooped up $1,000,000,000 OF PROFIT PER WEEK (twice the entire bitcoin economy last I checked)? THAT’S who you think best represents Bitcoin?

Here, I can do crappy graphs too: https://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1363839231742&chddm=121601&chls=IntervalBasedLine&q=NASDAQ:ZNGA&ntsp=0&ei=84hKUejREcmpigLBMw

March 20, 2013 @ 9:21 pm

The point was that financial markets are fractal in nature and that patterns like are unfolding now with bitcoin are not uncommon at all. I did not chose apple as an example, somebody else did. calm down.

March 20, 2013 @ 9:37 pm

Listen, as a gay woman I’ve had to deal with a lot of discrimination in my life so pardon me if I’m “high strung”.

March 21, 2013 @ 8:59 am

Don’t be silly. Of course Bitcoin is not comparable to Apple. Bitcoin is going to be much bigger than Apple.

As for crappy graphs, isn’t entire argument of this buttcoin post based on a crappy graph?

March 20, 2013 @ 12:21 pm

I’ll buy the dip when Bitcoin does retrace $40 – $50. Bitcoin is making higher highs and higher lows as more and more people download the client and decide to give it a try!

The owner of this site is basically the same chicken little moron calling the top in gold for the past ten years LOL!!

March 20, 2013 @ 6:58 pm

Mr Buttcoinman. Ill give you a small hint about any financial markets: If everybody say its a bubble, it isn’t. If everybody say its not a bubble, it is. Right now, here, in the media, on the bitcoin forums everybody yells bubble bubble. As long as people yell bubble the price will continue to rise. The time to watch for is when people stop yelling bubble and come up with rationalization why it isn’t a bubble. So far iv’e only seen one post that claims the price is justified. Doubtless its going to correct downwards after a rally like this, but only to let the market verify that the increase in price was justified, the next leg up for bitcoin is going to be _spectacular_ like rarely seen.

March 20, 2013 @ 7:01 pm

You just not read bitcointalk or reddit because there’s nothing on those forums but “true believers” and anyone that says otherwise gets down voted to hell or labeled a troll.

March 20, 2013 @ 7:54 pm

So basically you dont like them because they are like you, just the opposite direction? I think your judgement is clouded as much as the “true believers”. It is difficult not to see that the properties that bitcoin inherit are not attractive in today’s economic climate and that a lot of people will find bitcoin desirable. Im sure you are located in a western country. Did you know that something as simple as a visa/mastercard to do online purchases is unavailable to something like 80-85% of the worlds population? It doesn’t mean they are all poor or useless, its just a simple legal structure that prevents them from entering the global market. If you can seriously say that bitcoin does not serve a great purpose for these people i would sincerely like to know why.

March 20, 2013 @ 8:51 pm

65% of the world’s population doesn’t even have the internet. How is bitcoin going to serve people who can’t even get access to regular banking services?

“Well shit, just hop onto Mount Gox here and buy some bitcoins and .. hey where are you going?? What do you mean you have to search for potable water??? I have some very interesting libertarian views to share with you….”

March 20, 2013 @ 9:40 pm

65% do have internet, much much more already. Internet through smartphones and internet cafes provides basic access to most of the worlds population. Even here in Philippines a brand new perfectly good Samsung smartphone with android on it cost under 100 USD, this is completely within range of everyone here, and most people have one. Internet subscriptions are very cheap, with free wifi zones many places. This have put internet in the hands of billions of people, the next two-three years we will see the price plummet further on such phones down to around $25 a pop. There is going to be 100% internet penetration in all developing countries. Combine this with young populations that are tech hungry and willing to spend loads of time educating themselves working for cheap online. Just here in Cebu where im staying there are currently around 120.000 young people working in calling centers for western companies, They speak completely fluent English and they have good skills. The problem right now is that these people need a whole lot of financial structure around them in able to get paid for their work. These walls are coming tumbling down. Bitcoin vendors are already starting to pop up here and people are starting to take payment in bitcoin. This will break down all barriers for real globalization. I think you have to have a limited imagination if you cant see the contours of the possibilities that are being drawn here. This is not a matter of “libertarian” views (im not a libertarian), its a matter of access to basic financial services and access to a global market for products and services. With a smartphone and a brainwallet these people _will_ have access to banking services that are much better than what they have already. They have the internet access, the smartphones but they still have to hide their cash in tin cans under the bed, You should take a holiday and travel to some developing countries, there are more things happening than you would imagine.

March 21, 2013 @ 3:08 pm

No, really, it’s only 35% of people in the word who have either landline or mobile broadband. We just surpassed 2.3 billion people online, 500 mil with landmine and rest on mobile broadband. You still have a huge chuck of the global population that have no way to use an online currency.

http://www.un.org/apps/news/story.asp?NewsID=43424&Cr=digital+divide&Cr1#.UUuDdBzvsaA

http://www.itu.int/ITU-D/ict/statistics/at_glance/KeyTelecom.html